First and foremost, let’s begin by answering these questions:

1. Did you take the 6-month housing loan moratorium?

2. If so, were your investment properties tenanted throughout the moratorium?

3. During the moratorium, did the tenant (lucky for you) continue to pay rent?

If your answers are YES, please continue to read.

For LHDN, rental income has a number of allowable tax deductions for an investment property:

1. Interest on the mortgage principal amount;

2. Maintenance fees;

3. Quit rent and assessment taxes;

4. Ordinary repairs to maintain the property in its existing state; and

5. Fire/burglary insurance premiums

In a typical year, if your expenses for property investment (yearly mortgage interest costs + maintenance fees + quit rent & taxes + ordinary repairs) is greater than your total rental income, your tax liability for rental income is zero.

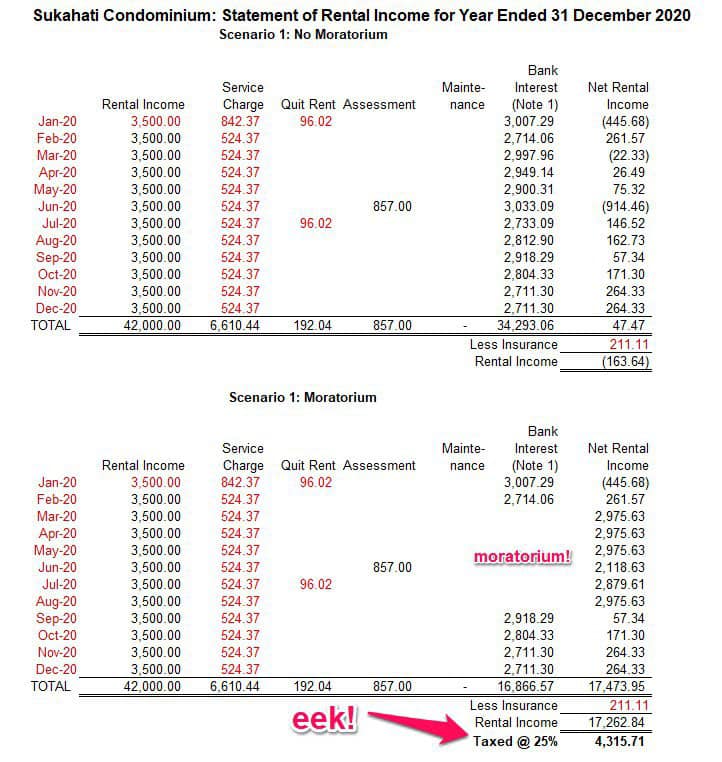

The picture below illustrates rental income during normal times and an added scenario of this year’s moratorium + rental income.

As you can see, this year, if you happen to have opted for the loan moratorium AND happen to enjoy rental income from a paying tenant (whether in full or partially), then it may be worth recalculating your rental income for the year… as you could be in for quite the sticker shock come tax filing in 2021.

Consider yourself warned because the taxman cometh!

#taxplanning

#moratorium

#licensedfinancialplanner

SO YOU THINK THE MORATORIUM IS A TAX-FREE LUNCH?