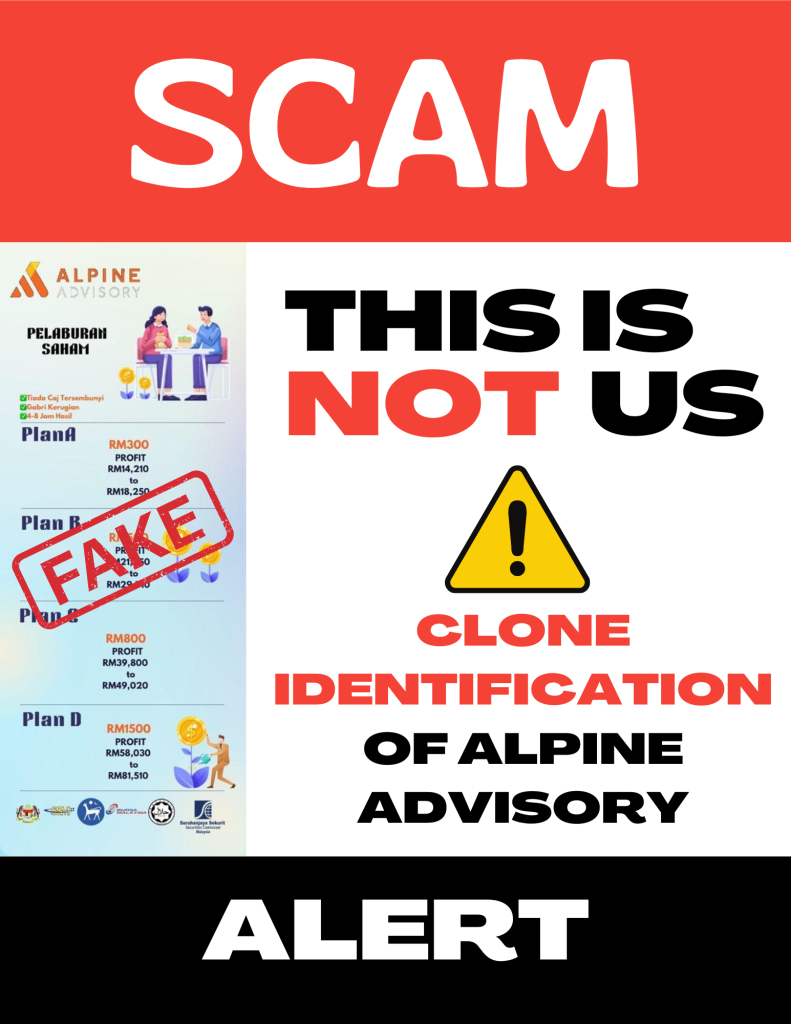

Beware of Scam

Financial scams are on the rise, and it’s important to be aware of the warning signs. Fraudsters use clever tactics to gain access to your money, so always be skeptical of unsolicited calls or emails. Remember, if an offer sounds too good to be true, it probably is. Protect yourself by doing your research, asking …